Introduction

The Tesla (TSLA) company, founded by Elon Musk, is a leading electric car manufacturer that has been in the trend in recent years. Tesla’s stock price has touched the sky, and now it is considered among the most valuable companies in the world.

In this blog, we will try our best for a Tesla (TSLA) stock price prediction so that you can make investments and understand it.

In recent years the demand for EV vehicles has skyrocketed, indirectly benefiting the company. The strong financial performance is the main reason behind the price in the stock price of Tesla (TSLA) Motors.

Tesla has been considered the number one and the best EV maker in the world, and Elon Musk tries their best to sustain the number one rank and dominate the EV market.

The great success of Tesla becoming the number one EV vehicle manufacturer globally also has some drawbacks: its high or overvaluation are some of the reasons.

Despite these drawbacks, Tesla is still the most popular stock in the world for investment because the company brings innovative ideas that bring revolution to the world.

Overview of Tesla (TSLA) motors.

| Name | Tesla, Inc. |

| Founded Year | 2003 |

| Founder | Elon Musk |

| Industry | Automotive |

| Total Assets | US$82.34 billion (2022) |

| Number of Employee | 127,855 (2022) |

| Official Website | www.tesla.com |

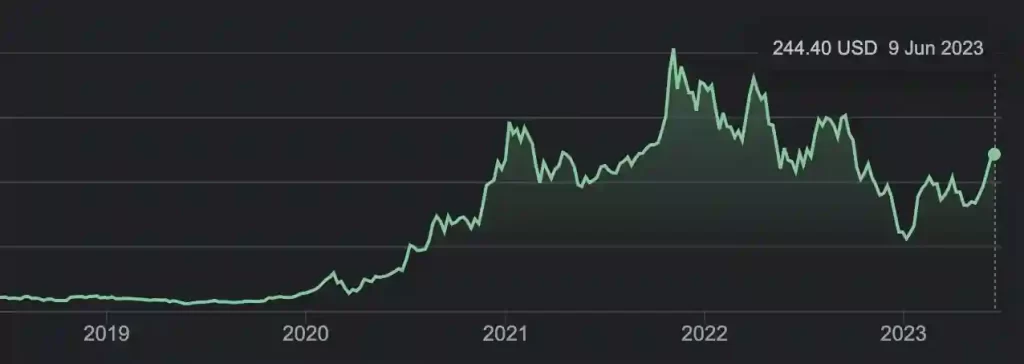

Tesla (TSLA) Stock Price History

Before going forward with Tesla’s stock price prediction and forecast, let’s look into the previous historical performance of Tesla (TSLA) from the year 2010 to 2023 Because, since 2010, the company’s stock price has risen by 10,000%, which is huge.

| Year | Stock Price (USD) |

| 2010 | $17.00 |

| 2011 | $19.00 |

| 2012 | $24.00 |

| 2013 | $29.00 |

| 2014 | $34.00 |

| 2015 | $39.00 |

| 2016 | $44.00 |

| 2017 | $59.00 |

| 2018 | $323.00 |

| 2019 | $254.00 |

| 2020 | $400.00 |

| 2021 | $900.00 |

| 2022 | $1,000.00 |

| 2023 | $1,200.00 |

Tesla stock price prediction from (2024-2070)

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2023 | $1,200 | $1,250 | $1,300 |

| 2024 | $1,300 | $1,350 | $1,400 |

| 2025 | $1,400 | $1,450 | $1,500 |

| 2030 | $2,000 | $2,200 | $2,400 |

| 2035 | $3,000 | $3,500 | $4,000 |

| 2040 | $4,000 | $5,000 | $6,000 |

| 2050 | $5,000 | $7,000 | $8,000 |

| 2060 | $7,000 | $10,00 | $12,000 |

| 2070 | $10,000 | $15,000 | $20,000 |

Tesla stock price prediction 2023

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2023 | $1,200 | $1,250 | $1,300 |

Tesla stock price prediction 2024

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2024 | $1,300 | $1,350 | $1,400 |

Tesla stock price prediction 2025

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $1,400 | $1,450 | $1,500 |

Tesla stock price prediction 2030

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $2,000 | $2,200 | $2,400 |

Tesla stock price prediction 2035

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $3,000 | $3,500 | $4,000 |

Tesla stock price prediction 2040

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $4,000 | $5,000 | $6,000 |

Tesla stock price prediction 2050

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $5,000 | $7,000 | $8,000 |

Tesla stock price prediction 2060

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $7,000 | $10,000 | $12,000 |

Tesla stock price prediction 2070

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| $10,000 | $15,000 | $20,000 |

Factors Affecting Tesla (TSLA) Stock Price

Now let’s look into the strong factors that directly or indirectly affect the price of Tesla stock.

This will include the financial performance of the company, the Global economy, and some of the technological advances and innovative ideas of Tesla (TSLA).

Financial performance

The financial performance of Tesla (TSLA) is very strong when you consider the company’s annual revenue growth earnings and cash flow, which are some of the strong indicators that make investors invest in Tesla stock for their great future.

Global economy

The global economy is also one factor that directly affects the Tesla stock price, and when the global economy becomes stronger, the companies become stronger.

Here the demand for the last test product was rising because the global economy was Rising gradually.

Technological advancements

Tesla (TSLA) is known for the technology which it uses to bring revolution in the world and directly impact the stock price of Tesla.

Tesla is always ahead of its competitors in bringing new products with advanced technology.

Tesla (TSLA) Stock Analysis

When you analyze the stock of any company, you can use three main factors for it. Such as fundamental analysis, technical analysis, and sentiment analysis

Fundamental analysis

Fundamental analysis of any stock is done by analyzing the company’s financial performance by evaluating the company’s earnings, cash flow, and so on.

Technical analysis

To do a technical analysis of any stock, we need to analyze the stock’s historical performance to predict the stock’s future and its price. This can be done by the method called chart reading.

Sentiment analysis

Some people give their own opinions on whether the price of any stock will rise or fall in the future; this is called sentiment analysis.

Here analysts can use social media data as resources from the investors to do sentiment analysis.

You might have heard about the GameStop stock, where the community called the Superstonk created a community on Reddit and started to give its opinion.

This type of activity is known as sentiment analysis or sentiment opinions.

Risks and Opportunities for Tesla (TSLA) Investors

Being number one in the market doesn’t mean any risk. Being number one will have disadvantages, such as the competitor continuously trying to reach your position.

Let’s discuss the risk and opportunity Tesla will create for its investors.

Risks

Tesla (TSLA) is a high-value company. The sharp price in the stock price of Tesla can also have a sharp decline in the price of Tesla stock.

New and innovative companies have entered the EV market, directly competing with Tesla, such as General Motors and Ford.

If there is a fault in any of Tesla’s products, then the demand for Tesla’s products may decrease, affecting the price of Tesla stock.

Opportunities

Tesla (TSLA) has a bundle of opportunities in the future because the demand for heavy vehicles is continuously on the rise.

If Tesla manages to be number one for a long time, we can expect a sharp price in Tesla stocks.

Tesla is famous for bringing the best product to the market, such as the cyber truck and the semi that can be expected soon.

These products can help Tesla grow its sales and profit from it.

Tesla (TSLA) plans to expand its manufacturing unit in new markets, such as China and India, because China and India have a large populations, which can create new opportunities for its growth.

conclusion

Tesla (TSLA) is a huge company with a lot of potential to grow. It has already built its brand and reputation for the innovation and technology that they bring in its new vehicles.

Tesla (TSLA) has some risks, such as its high valuation competition from other manufacturers, so it is advisable to research before investing in Tesla.

Note: The price updated on the table is just a prediction based on the historical performance and the average growth rate. Please do your research before investing in any stock.

You can checkout our similar predictions for Rivian stock price and Lucid stock price which might help you in the long run.

Comments are closed.