We will do a deep analysis of JEPI price prediction and forecast which will help investors to make an informed decision.

What is JEPI?

JEPI stands for JPMorgan Equity Premium Income ETF.

JEPI is an investment fund that wants to give people a steady income and make their money grow by investing in a mix of different U.S. stocks that are likely to do well. JPMorgan Asset Management takes care of JEPI started in October 2018.

| Name | J.P. Morgan & Co. |

| Industry | Investment banking Asset management Private banking |

| Founded year | 1871 |

| Founder | J.P. Morgan |

| Official Website | www.jpmorgan.com |

How does JEPI work?

The JEPI investment team follows a special algorithm that helps the team to identify the undervalued stocks in the U.S.

These undervalued stocks are expected to outperform the market and are pic, especially by the JEPI investment team.

JEPI also uses a strategy called covered call writing to generate income. This strategy involves selling call options on the stocks in the fund’s portfolio. The money from selling these options is used to cover expenses and pay dividends to investors.

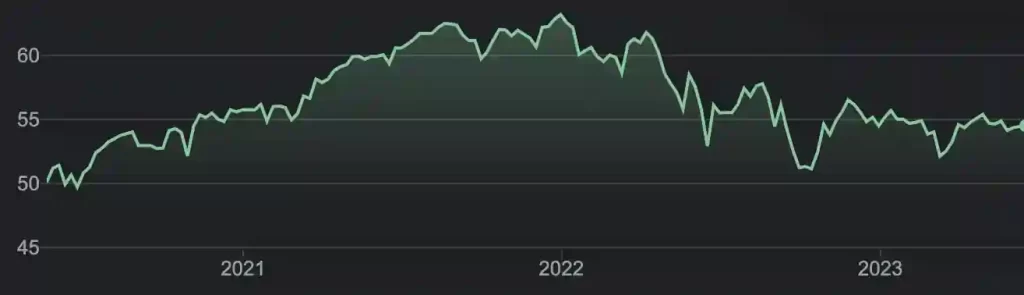

JEPI’s performance history

JEPI has performed well since it started. The fund provided a total return of 42.6% as of March 8, 2023.

When you compare this with S&P 500 index, it has given the more return S&P 500 index has given a return of 38.5% over the same period.

JEPI stock price predictions (2023-2070)

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2023 | $49.00 | $52.00 | $55.00 |

| 2024 | $51.00 | $54.00 | $57.00 |

| 2025 | $53.00 | $56.00 | $59.00 |

| 2030 | $57.00 | $60.00 | $63.00 |

| 2040 | $61.00 | $64.00 | $67.00 |

| 2050 | $65.00 | $68.00 | $71.00 |

| 2060 | $69.00 | $72.00 | $75.00 |

| 2070 | $73.00 | $76.00 | $79.00 |

JEPI price prediction 2023

The JEPI stock price prediction for 2023 will be around $52.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2023 | $49.00 | $52.00 | $55.00 |

JEPI price prediction 2024

The JEPI stock price prediction for 2024 will be around $54.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2024 | $51.00 | $54.00 | $57.00 |

JEPI price prediction 2025

The JEPI stock price prediction for 2025 will be around $56.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2025 | $53.00 | $56.00 | $59.00 |

JEPI price prediction 2030

The JEPI stock price prediction for 2030 will be around $60.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2030 | $57.00 | $60.00 | $63.00 |

JEPI price prediction 2040

The JEPI stock price prediction for 2040 will be around $64.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2040 | $61.00 | $64.00 | $67.00 |

JEPI price prediction 2050

The JEPI stock price prediction for 2050 will be around $68.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2050 | $65.00 | $68.00 | $71.00 |

JEPI price prediction 2060

The JEPI stock price prediction for 2060 will be around $72.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2060 | $69.00 | $72.00 | $75.00 |

JEPI price prediction 2070

The JEPI stock price prediction for 2070 will be around $76.00.

| Year | Minimum price (USD) | Average price (USD) | Maximum Price (USD) |

| 2070 | $73.00 | $76.00 | $79.00 |

Factors influencing JEPI’s price predictions

Economic growth

JEPI’s performance is closely tied to the overall health of the economy. When the economy grows, corporate earnings increase and interest rates are low, JEPI tends to do well.

Corporate earnings

Corporate earnings also influence JEPI’s performance. When corporate earnings rise, JEPI usually performs well.

Interest rates

Interest rates impact JEPI’s performance. When interest rates are low, JEPI tends to perform well. This is because JEPI generates income by selling call options, and the premiums received from these options are higher when interest rates are low.

JEPI price prediction models

Fundamental analysis

This approach values a company by analyzing its financial statements and other factors. Fundamental analysts estimate a company’s intrinsic value, the price at which it should be traded.

Technical analysis

This method predicts future price movements by analyzing historical price data. Technical analysts look for patterns and trends that may indicate future price changes.

Is JEPI a good long-term investment?

JEPI has a strong performance record and is expected to continue performing well. It is a good choice for investors seeking income and potential growth.

Reasons to consider JEPI as a long-term investment:

High dividend yield

JEPI offers a high dividend yield of 11.43%. This means investors can earn a significant amount of income from their investments.

Low expense ratio

JEPI has a low expense ratio of 0.35%. This means investors can keep a larger portion of their investment earnings.

JEPI achieves this by selling covered call options on a group of S&P 500 Index stocks. This strategy generates income for JEPI while also reducing its volatility.

Is JEPI a good investment?

It all depends from person to person, like the investment goals and investor’s risk tolerance.

If you seek high income with low volatility, JEPI may be a suitable option. However, there may be better choices if you desire high growth potential.

How does JEPI generate a high dividend?

JEPI generates a high dividend by selling covered call options on a group of S&P 500 Index stocks. When JEPI sells a covered call option, it agrees to sell its shares of the underlying stock at a predetermined price on or before a specific date. In exchange, the buyer of the call option pays JEPI a premium. JEPI uses the premiums from selling call options to pay its dividend.

The income JEPI earns from selling call options depends on market volatility.

In periods of market volatility, JEPI observes an uptick in the premiums it receives. This can be attributed to investors’ inclination to pay a higher amount for the chance to acquire shares of a stock at a predetermined price, particularly when they anticipate an increase in the stock’s value.

However, JEPI’s high dividend yield also carries risks. One risk is that the market may increase significantly, forcing JEPI to sell its shares of the underlying stock at a lower price than it paid. This could result in a loss for JEPI and its shareholders.

Another risk is that JEPI may not generate enough income from selling call options to cover its dividend.

In the event of significant market volatility, the premiums received by JEPI might not be enough, potentially resulting in a reduction of the dividend payments.

Related Articles

1. Miso robotics stock price prediction